Subscribe to our Telegram channel

Cryptocurrency analyst predicts bitcoin will fall by 60% due to one problem

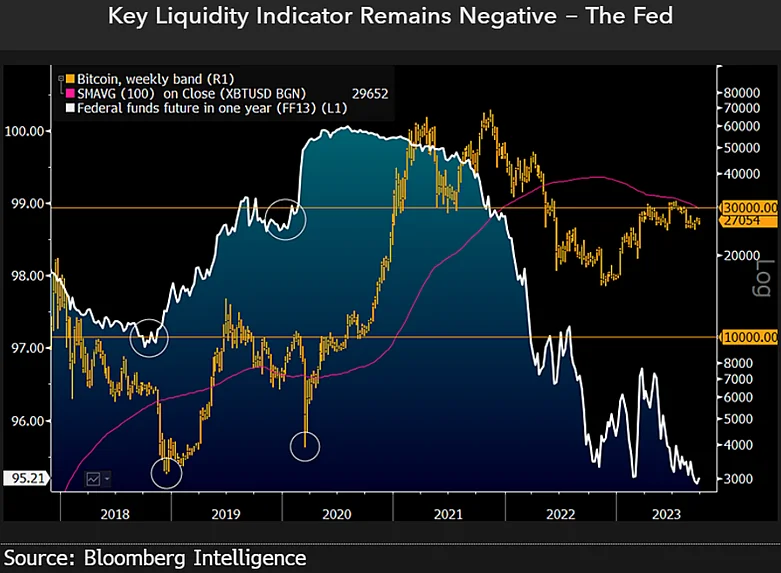

Mike McGlone, senior macro strategist at Bloomberg Intelligence, said that bitcoin could be on the verge of a 60% drop in price. According to McGlone, the key indicator for BTC is that liquidity remains negative and global rates continue to rise «despite the signals of recession.»

The analyst still believes that the United States will experience a recession by the end of 2023. He noted that the key resistance for BTC $66,200.84 Mezo Wrapped BTC -1.33% Market capitalization $37.4 million VOL. 24 hours $1.61 billion is the $ 30,000 level, and his «risks are leaning toward $ 10,000.»

McGlone emphasized that the biggest risk to the crypto sector as a whole will be the pressure from the recession-related stock market decline. «The weakness of cryptocurrencies in the third quarter could be a surge in recovery or a harbinger of recession. We are leaning towards the latter, as almost all risky assets were received in 2023 and transferred to this quarter. Most central banks continue to tighten monetary policy, despite signs of recession in the US and Europe, as well as the real estate crisis in China, which has deflationary implications,» McGlone said.

The relative underperformance of the Bloomberg Galaxy Crypto Index (BGCI) may reflect the actual changes for the asset class, which has grown on zero interest rates. «The sharp rise in U.S. Treasury yields in 1987 peaked a week before the crash, while oil prices peaked in July 2008. We see parallels ,» the analyst emphasized.

Arthur Hayes believes that if the US Federal Reserve starts printing money again, the commodity market will experience rapid growth. One of the signals that the Fed will need to change course and support the US economy, the expert believes, is the alarming situation in the bond market. According to him, long-term bond interest rates are growing faster than short-term ones. This yield curve pattern is often a bearish signal for stocks and risky assets.