Subscribe to our Telegram channel

Bitcoin risks falling to $ 25,000

The price of the flagship crypto asset BTC $68,345.94 Mezo Wrapped BTC 6.15% Market capitalization $37.49 million VOL. 24 hours $2.16 billion has fallen by about $ 4,000 since the approval of bitcoin exchange traded funds(ETFs) in the United States. Meanwhile, technical chart patterns hint at the possibility of a continued bitcoin selloff in the coming days or weeks.

What can happen and how low can the price of bitcoin go?

As shown on the daily chart below, bitcoin’s price trajectory is consolidating within a bullish channel.

the 50-day exponential moving average(red wave on the chart — ed.) has provided support for BTC at $ 42.12. However, the Relative Strength Index (RSI) is hovering near the midline, indicating that there is no strong bullish momentum.

In addition, the RSI has recently formed lower highs in contrast to Bitcoin’s higher highs, which is a sign of growing bearish divergence.

Therefore, if the BTC price breaks below the 50-day moving average, it could look for next support near the lower trendline of the bullish channel. This trend line coincides with the 200-day EMA of bitcoin(blue wave on the chart — ed.) near $ 34,850, a low that has not been seen since Q4 2023, the consolidation phase.

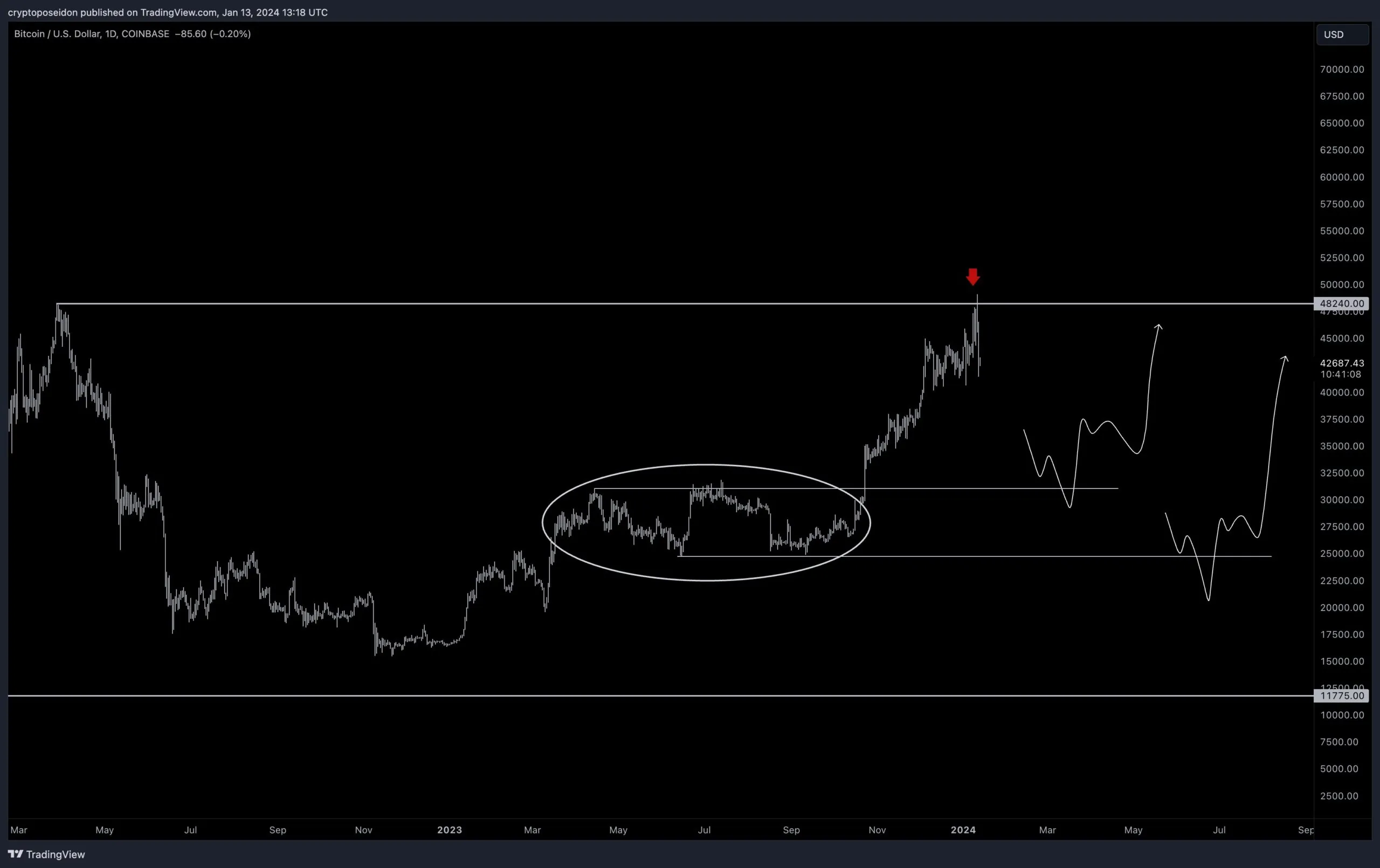

Nevertheless, a crypto expert known by his pseudonym, Crypto Poseidonn, believes that the price of bitcoin will fall to the range of $ 25,000-$ 30,000.

According to the analyst, in the first scenario, investors who bought bitcoin at a price of $ 25,000 to $ 30,000 while waiting for the ETF to be approved will not make much profit, as bankers are unlikely to pay them a significant premium over these prices. Therefore, when bitcoin approaches $ 30,000, bankers may buy up the asset from investors, setting a new market bottom.

However, in the second scenario, the market could correct below $ 25,000, allowing new institutional investors to buy even more BTC using leverage.

In turn, Crypto trader il Capo expects that this level is likely to be broken even before the final price target of $ 12,000 is reached.

«Interest rates were rising during 2004−2007, and when the Fed changed its policy, the market started to fall to new lows,» the trader explained his reasoning on the X platform.

The ability of bitcoin to keep prices above the 50-day EMA will determine whether further growth is expected in the short term.

At the time of writing, the main cryptocurrency is trading at $ 42,713 with a market capitalization of $ 837.4 billion, down 0.53% overnight. Traders made daily trading deals worth $ 19.8 billion, an increase of 18.25%. Bitcoin’s dominance in the market has dropped to 49.8%, and the Fear and Greed Index shows pessimistic sentiment in the industry at 59 points.