Subscribe to our Telegram channel

Sui token grew by 800% in five months

Last October, the first-level network (L1) Sui was accused of manipulating the supply of the ecosystem’s native token. At that time, the price of SUI broke through a historic low. However, since then, the coin has managed to triple in value. Crypto experts have figured out what is behind the positive dynamics.

The entire crypto market has been growing amid expectations of the U.S. Securities and Exchange Commission’s (SEC) decision to launch spot bitcoin ETFs. SUI also benefited from the bullish momentum.

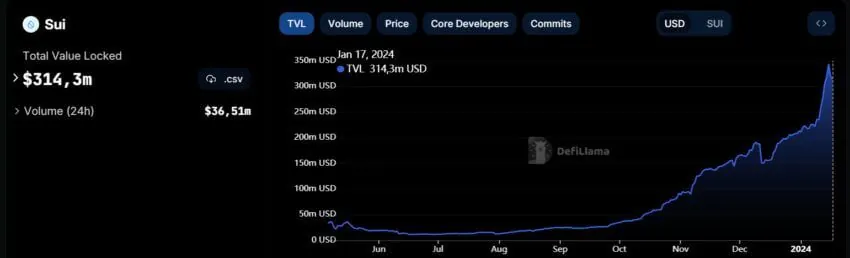

According to DefiLllama, in October 2023, Sui’s TVL was $ 34 million. Since then, the figure has increased by more than 800% to $ 314 million.

The growth was also facilitated by the positive dynamics of some projects in the L1 network. In particular, over the past month, the Scallop Lend lending protocol has grown by 107%, and Navi by 117%.

Meanwhile, the value of the SUI token has increased by 225% in three months, according to TradingView analysts. Amid the accusations in October, the price of the asset fell to $ 0.367. At the time of writing, it stands at $ 1.24.

In general, the SUI rate has increased by 53% over the past week. The coin’s market capitalization is currently at $ 1.3 billion, and the trading volume over the past 24 hours amounted to $ 447 million.

What is behind the growth of SUI?

Since the launch of the Sui mainnet in May 2023, a number of new projects have been attracted. The largest of them is the lending protocol Solend, which announced plans to expand to Sui in late December. It ranks seventh among the largest projects on the Solana blockchain SOL $103.27 Binance-Peg SOL 0.08% Market capitalization $0.11 billion VOL. 24 hours $0.3 billion .

Integration has become a key factor in the growth of the L1 network. Solend will be launched on Sui as a decentralized application (dApp) called Suilend. According to DefiLllama, Solend’s TVL is $ 170 million. Most of the funds are blocked in the Bonk project’s memo coin (BONK), which exceeds 110 billion coins.

At the same time, the leading derivatives trading protocol Bluefin, built on the basis of Arbitrum, has also switched to the Sui platform. Such strategic collaborations are attracting an increasing number of developers to the L1 network, which increases both network activity and user confidence.