Subscribe to our Telegram channel

Bitcoin is predicted to plummet by 47%

Cryptocurrency analysts note that if the current bitcoin cycle BTC $62,953.33 Mezo Wrapped BTC -3.80% Market capitalization $35.65 million VOL. 24 hours $1.8 billion correlates with the previous ones, the price of the main cryptocurrency may soon fall by 47%. This would trigger a retest of the $ 32,000 area.

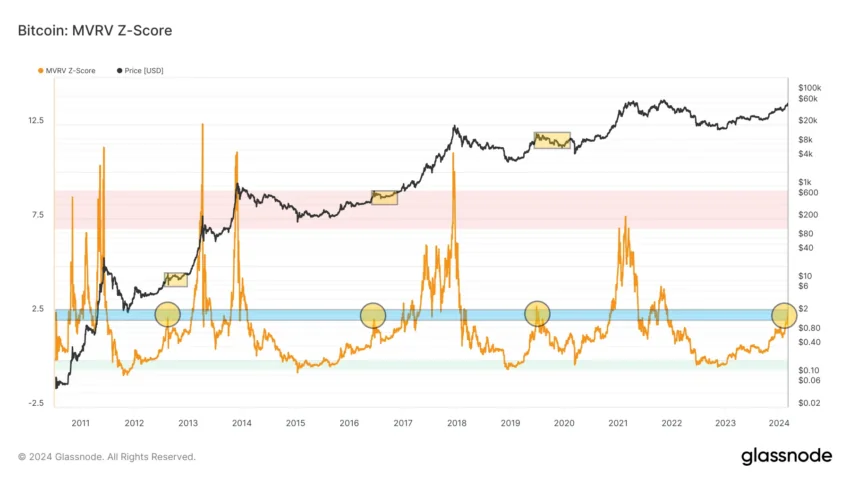

The MVRV Z-Score indicator helps to understand when bitcoin is overvalued or undervalued relative to its «fair value». As a rule, it moves in three ranges, but sometimes briefly breaks out of them in extreme conditions of the end of a bull or bear market:

- green area between 0 and -0.5 — fair value

- the area between 0 and 7 is the neutral fair value range

- red area between 7 and 9 — above fair value

The chart below shows that MVRV Z-Score entered band 2(blue — ed.) for the first time in this cycle. In all previous cycles, this was due to the approaching correction of the BTC price(yellow rectangles — ed.), after which the asset formed a higher low and continued to climb.

If a similar situation happens this time, the next 6 months could be a period of accumulation in the bitcoin market, as well as a great opportunity for other cryptocurrencies to grow and the start of the long-awaited altcoin season.

The MVRV Z-Score's achievement of this important area was also noted by a well-known analyst known as PositiveCrypto. However, he associates this area with a deviation, suggesting that BTC is still far from overheating.

Now we can calculate the depth of historical corrections and determine the support area to which the BTC price can fall. In 2012, the drawdown was 59%, in 2016 — 38%, and in 2020 — 53%. Thus, 47% can be taken as the average value.

If you overlay the potential correction on the current chart, interesting technical correlations emerge. A 47% drop in bitcoin from the current level will lead to support around $ 32,000, which is almost the same area as the Fibonacci retracement level of 0.618 of the entire upward movement from the lows of the current cycle. In addition, the $ 32,000 mark has repeatedly acted as support and resistance since 2021(blue arrows — ed.).

If the long-awaited correction occurs in the next 6 months, the $ 32,000 level will be a great area to buy. This is indicated by both technical correlations and the MVRV Z-Score online indicator.

As of the morning of March 1, the flagship asset has undergone a 2.85% correction and is trading at $ 61,554. The total number of coins circulating on the market is $ 1.2 trillion. Traders made daily trading deals worth $ 56.9 billion. Bitcoin’s market share is 52.8%.