Subscribe to our Telegram channel

Bitcoin lost $ 706 million over the week, and Ethereum — $ 91 million

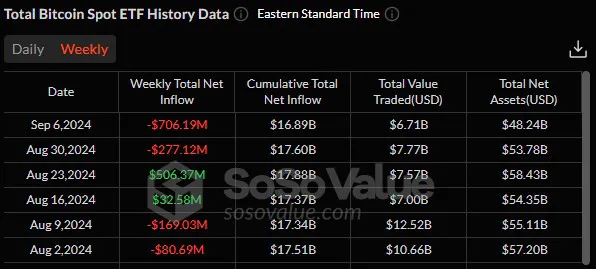

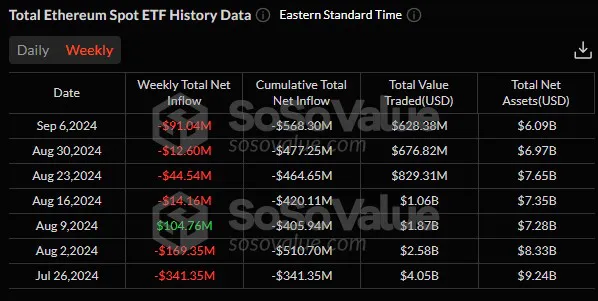

Over the past week, the cryptocurrency market has suffered serious losses due to significant outflows from exchange-traded funds (ETFs) related to bitcoin BTC $67,927.20 Mezo Wrapped BTC -0.48% Market capitalization $38.51 million VOL. 24 hours $1.06 billion and ethereum ETH $1,987.07 Bridged Ether (StarkGate) 1.41% Market capitalization $45.53 million VOL. 24 hours $0.71 billion . According to market analysts, Bitcoin ETFs lost $ 706 million and Ethereum ETFs lost $ 91 million.

In particular, on September 6, Bitcoin-ETFs registered a massive withdrawal of $ 170 million, which pushed the weekly outflow to a record $ 706 million. Similarly, Ethereum-ETFs also suffered losses, with the largest being a $ 10.7 million withdrawal from the Grayscale ETHE fund.

The overall market pressure caused by the volatility has led to a 5% drop in Bitcoin’s value to around $ 54,796, while Ethereum has lost over 12% over the past month to trade at $ 2,305.

The significant outflows have heightened investor fears and put additional pressure on cryptocurrency markets, although cryptocurrencies still have a 29% year-to-date gain for Bitcoin.

As a reminder, 10x Research analysts suggest that the price of bitcoin could fall to $ 45,000. «Bitcoin addresses peaked in November 2023 and declined sharply after the first quarter of 2024. When the number of BTC held by short-term holders began to decline in April and long-term holders took advantage of high prices to exit, it indicated that the top of the cycle had been reached,» the crypto experts explained.