Subscribe to our Telegram channel

Crypto market analysts predict bitcoin’s growth to $ 100,000

Bitcoin BTC $88,132.89 Mezo Wrapped BTC -0.37% Market capitalization $51.58 million VOL. 24 hours $1.44 billion showed an impressive 46.59% gain over the month, raising its capitalization to $ 1.94 trillion. However, further growth depends on a number of factors that experts say are crucial to reaching the $ 100,000 price level.

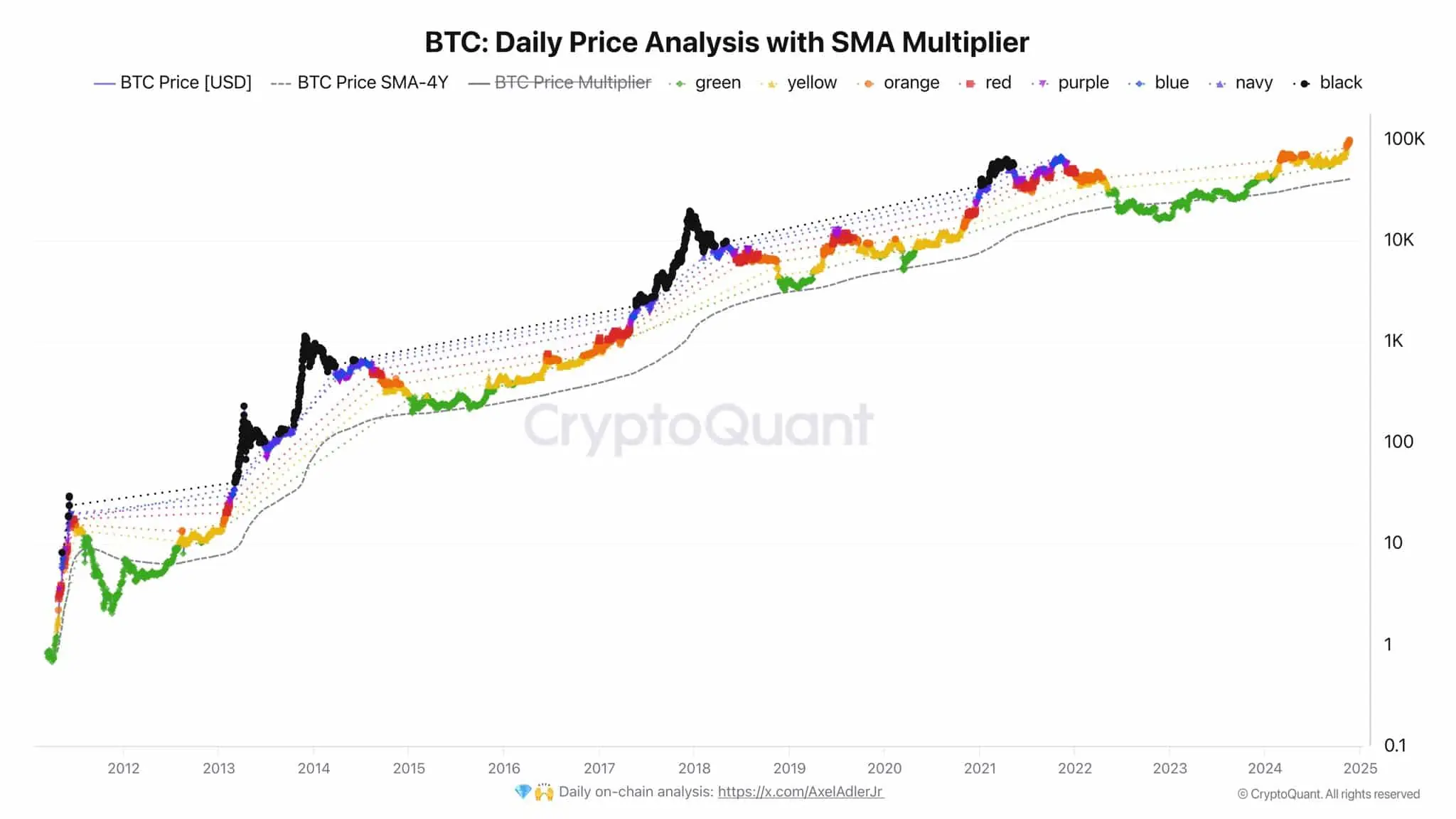

According to analyst Alex Adler Jr, bitcoin remains far from the peak of its market cycle.

Using the SMA Multiplier indicator, which analyzes cyclical trends, the expert noted that bitcoin is in the initial stages of growth.

Photo: x.com/axeladlerjr

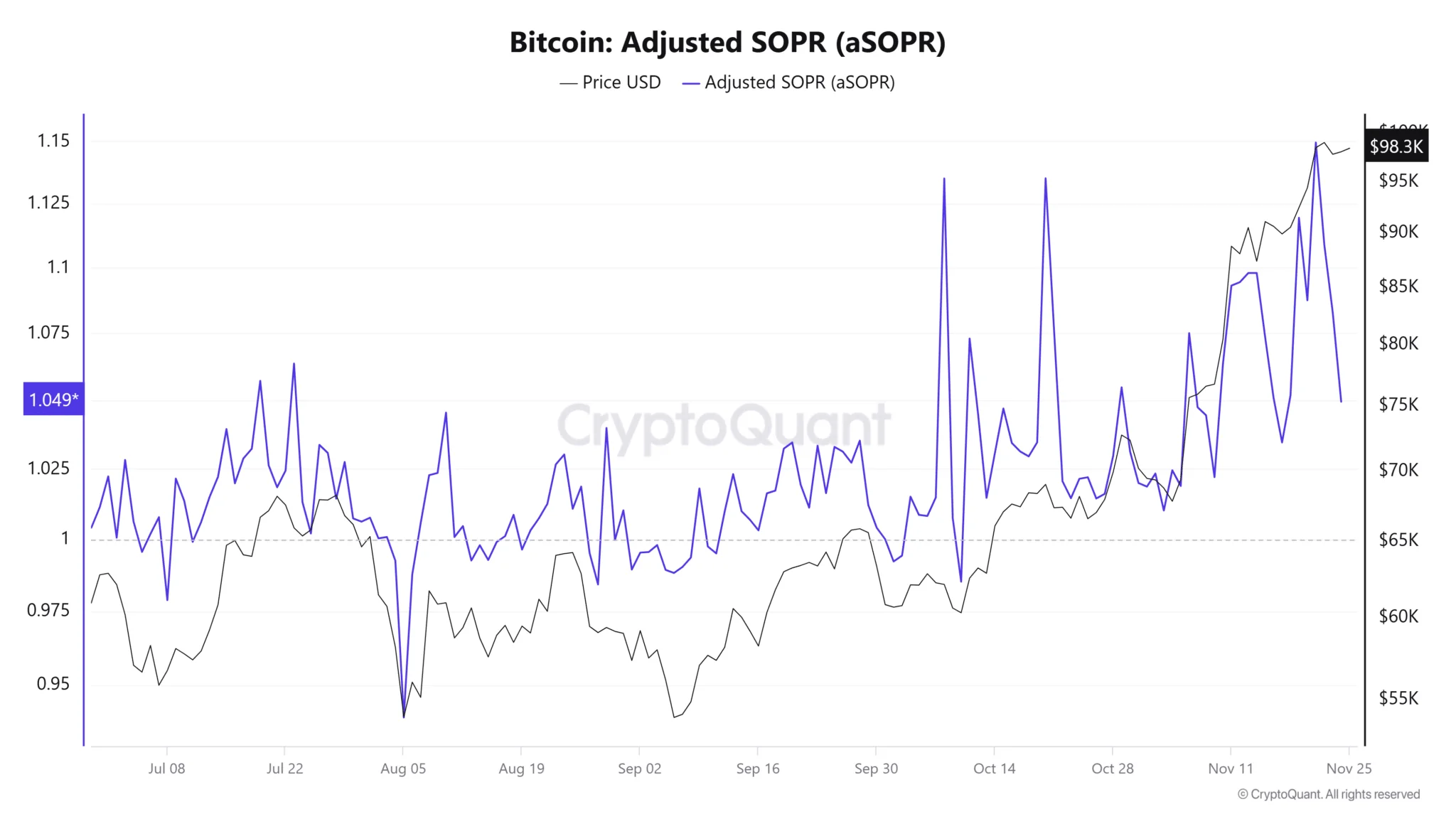

Meanwhile, CryptoQuant experts believe that the main obstacle to further growth is active selling on the wave of profit.

The aSOPR index, which reflects the ratio of sales to profit to losses, showed a value of 1.049. This indicates sales at favorable prices and puts additional pressure on the price of bitcoin and slows its rise.

Photo: Coinglass

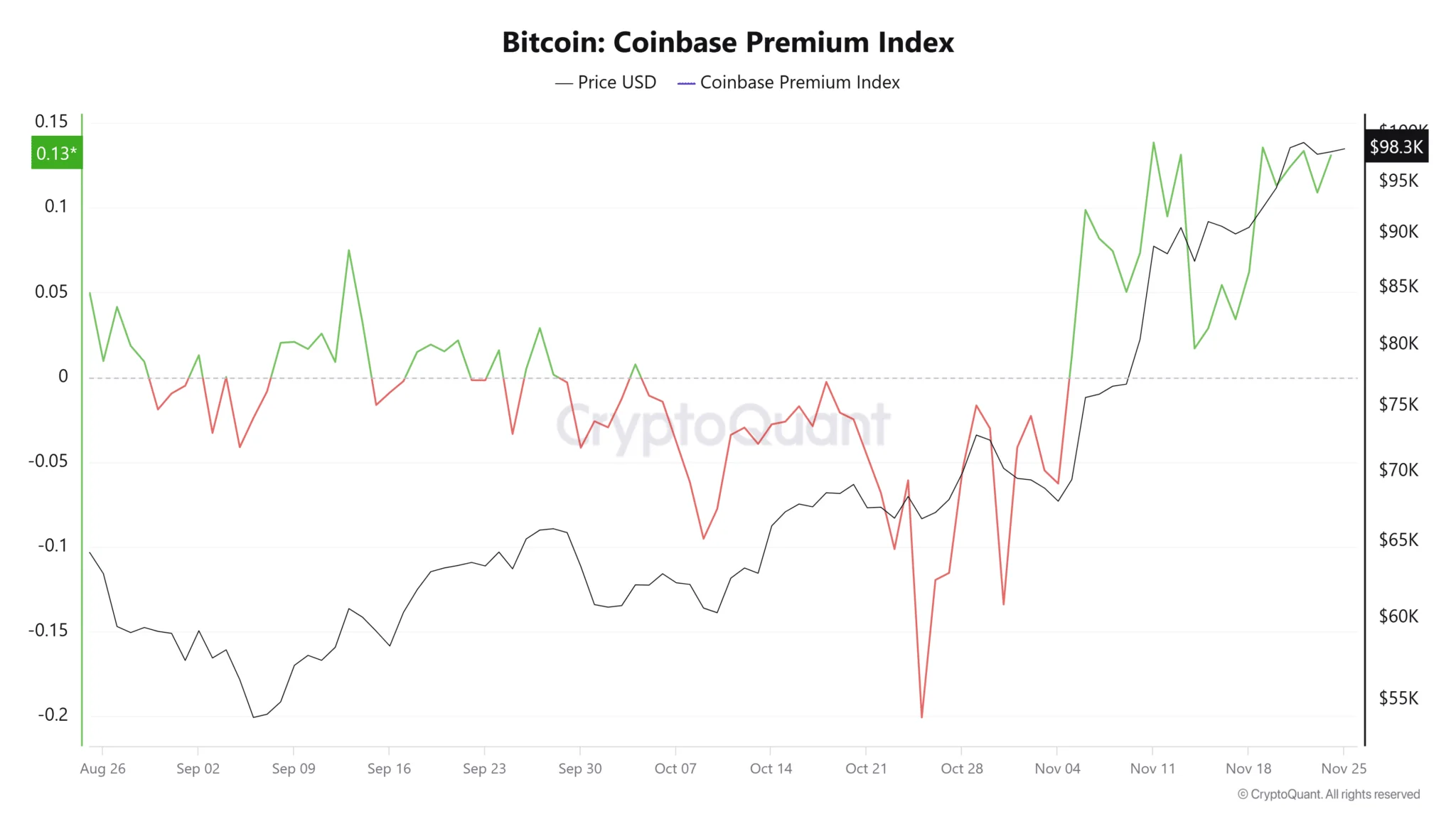

Despite the pressure from sales, demand among US investors remains stable.

The Coinbase Premium index, which reflects the difference in the price of bitcoin between Coinbase and Binance exchanges, reached 0.1308, which is close to the November high.

Photo: Coinglass

Analysts believe that in order to reach new heights, bitcoin needs to overcome pressure from sellers and improve market sentiment.

If demand remains strong and historical cyclical patterns repeat themselves, the cryptocurrency has a good chance of reaching a symbolic level in the coming months.

As it is known, on November 26, the price of bitcoin fell to $ 92,600, setting a local minimum. This happened after a sharp decline of $ 5,000 per day on November 25, which led to the liquidation of cryptocurrency positions worth more than $ 500 million.