Subscribe to our Telegram channel

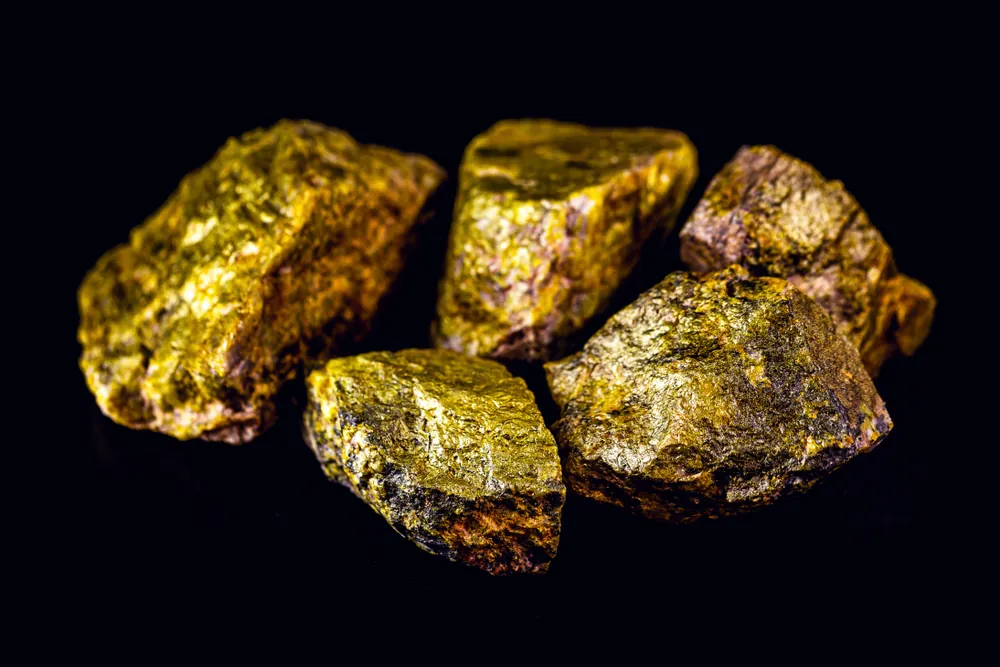

Cryptocurrency developers present the world’s first digital token backed by enriched uranium

Uranium3o8 (U) is a digital token backed by the nuclear mineral uranium. One U token is equal to 0.45 kg of verified uranium obtained from a licensed and regulated mining partner. PaySpace Magazine writes about the new cryptocurrency.

In the near future, the U token will go on public sale. The initial supply will be 20 million tokens. Since the asset operates on the Ethereum blockchain, it is an ERC20 token.

According to the developers of the new virtual coin, the goal of the Uranmium3o8 project is as follows: «To remove barriers in the traditionally opaque and inefficient uranium market, while increasing the availability of one of the world’s most important commodities.»

The company behind the development of Uranium3o8 is Sanmiguel Capital Investment. They are collaborating on the project with Madison Metals Inc.

When trading the U token, the user does not own real uranium. However, crypto users can receive a physical supply of uranium if they wish. In this case, they must meet strict requirements — own at least 20,000 U tokens, which is equivalent to 9 tons of uranium.

In addition, recipients must comply with local laws. They must provide proof of compliance with these requirements to Madison Metals Inc. After the uranium is delivered, Madison burns the U tokens that secured the supply.

The uranium itself comes from a mine in Namibia owned by Madison. Interestingly, the company has pledged to provide the crypto project with about 9072 tons of uranium.

The concept of Uranmium3o8 is not new. The world already has stablecoins backed by real assets such as precious metals and oil. By holding a stable coin backed by a commodity, the holder essentially owns a share of a tangible asset in the physical world.

From a technical point of view, stablecoins backed by commodities do not differ from coins backed by fiat money or cryptocurrencies. That is, the rate of digital coins is tied to the value of a commodity asset on international exchanges.

The scheme of operation remains the same as in the case of cash collateral. The issuer receives the collateral — oil, gold, etc. — and places it in the custody of a trusted depository or bank. Tokens are issued for the amount received. However, when the assets are transferred, they are destroyed.