Subscribe to our Telegram channel

Cryptocurrency strategist names the condition under which bitcoin will reach a historic high

The price of the flagship crypto asset BTC $67,767.41 Mezo Wrapped BTC -1.41% Market capitalization $38.41 million VOL. 24 hours $1.43 billion may reach a new all-time high of $ 112,000 under the influence of a significant inflow of investments into spot bitcoin exchange traded funds (ETFs).

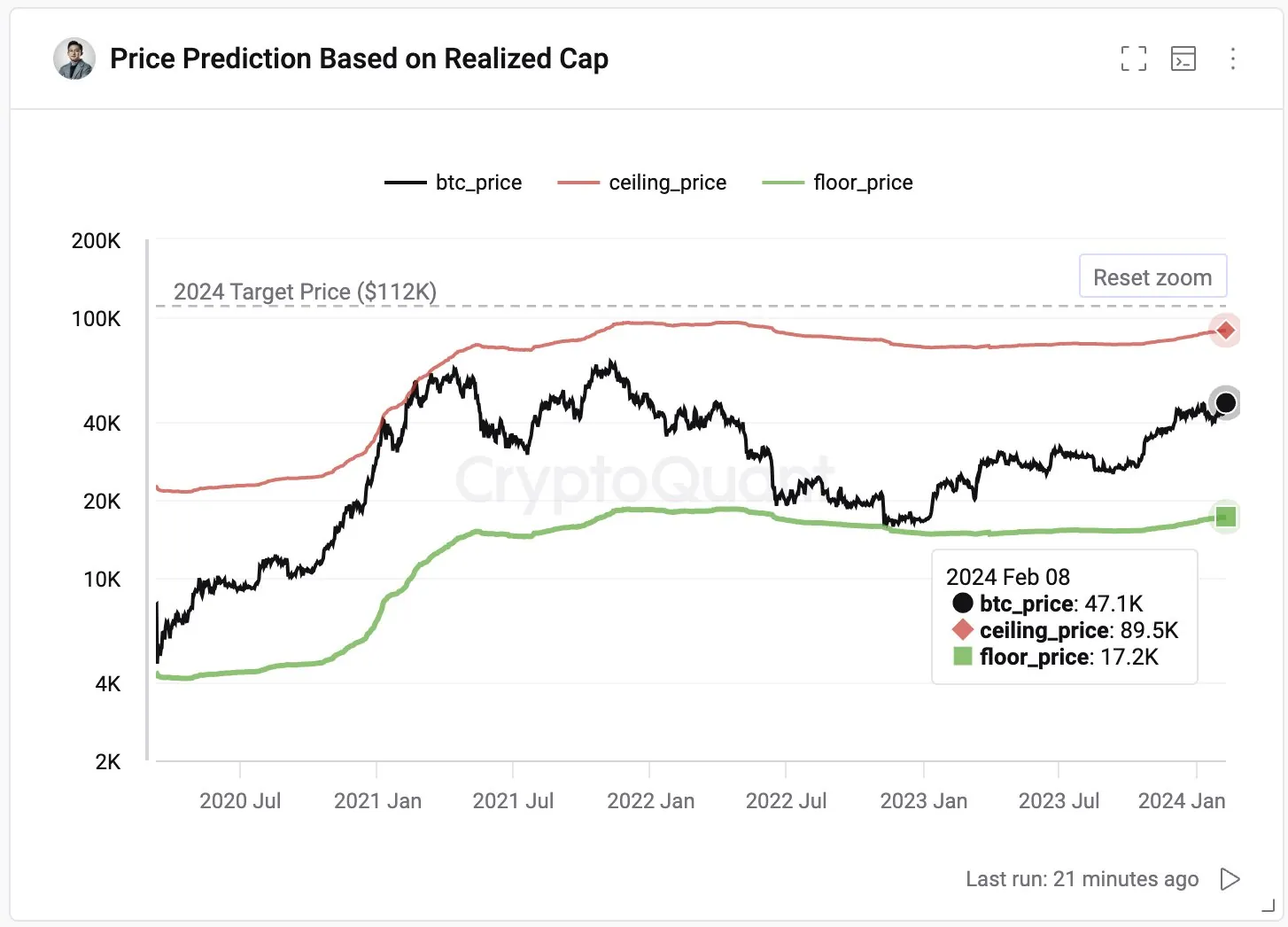

According to a recent report by CryptoQuant, the potential peak of the bitcoin price at $ 112,000 depends on continued buying pressure from inflows into spot bitcoin exchange-traded funds (ETFs). The analysis also outlined a «worst-case» scenario in which bitcoin could still rise to at least $ 55,000.

«The bitcoin market receives $ 9.5 billion in investments in spot exchange-traded funds every month, potentially increasing the realized capitalization by $ 114 billion per year,» said CryptoQuant founder and CEO Ki Yong Ju. — «Even with the GBTC outflows, a $ 76 billion increase could raise the realized cap from $ 451 billion to $ 527−565 billion.»

Joo clarified that historically, the bitcoin market has shown a pattern where its lowest points of value, or the bottom of the market, coincide with a market value to realized value (MVRV) ratio of 0.75, while the market peaks at an MVRV ratio of 3.9.

TheMVRV ratio compares the market capitalization (the current market value of all mined bitcoins) to the realized capitalization (the value of all bitcoins at the price at which they were bought), which serves as a key indicator for assessing extreme fluctuations in bitcoin value.

The report notes that if current trends of inflows into exchange-traded ETFs continue, the MVRV ratio could reach levels that typically indicate a market peak, potentially pushing the price of bitcoin to between $ 104,000 and $ 112,000.

As of the morning of February 12, the main cryptocurrency is down 0.22% and is trading at $ 48,233. The total number of coins circulating on the market is $ 946.4 billion. Traders made daily trading deals worth $ 19.4 billion. Bitcoin’s dominance in the market reached 52.5%.