Subscribe to our Telegram channel

CryptoQuant named 5 signs of BTC’s fall in the near future

CryptoQuant analysts have identified five key indicators that help assess whether Bitcoin BTC $70,481.99 Mezo Wrapped BTC -2.67% Market capitalization $38.83 million VOL. 24 hours $1.85 billion is close to a peak price. One of these indicators already shows a signal that a critical point may be reached.

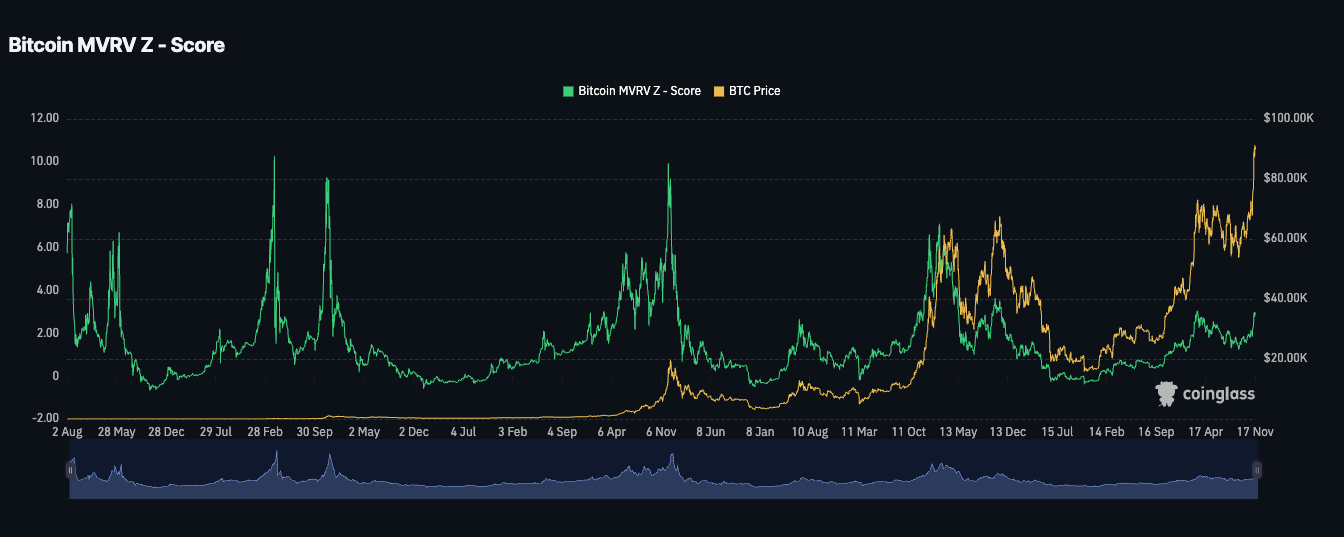

For example, the MVRV indicator compares the market value of Bitcoin with its realized value (the total value of all coins at the last sale price).

Thus, if the value exceeds 3.7, it may indicate the peak valuation of the asset. Currently, the indicator is 2.67, although in February 2021, it reached 7 when Bitcoin rose to $ 60,000.

Photo: CryptoQuant

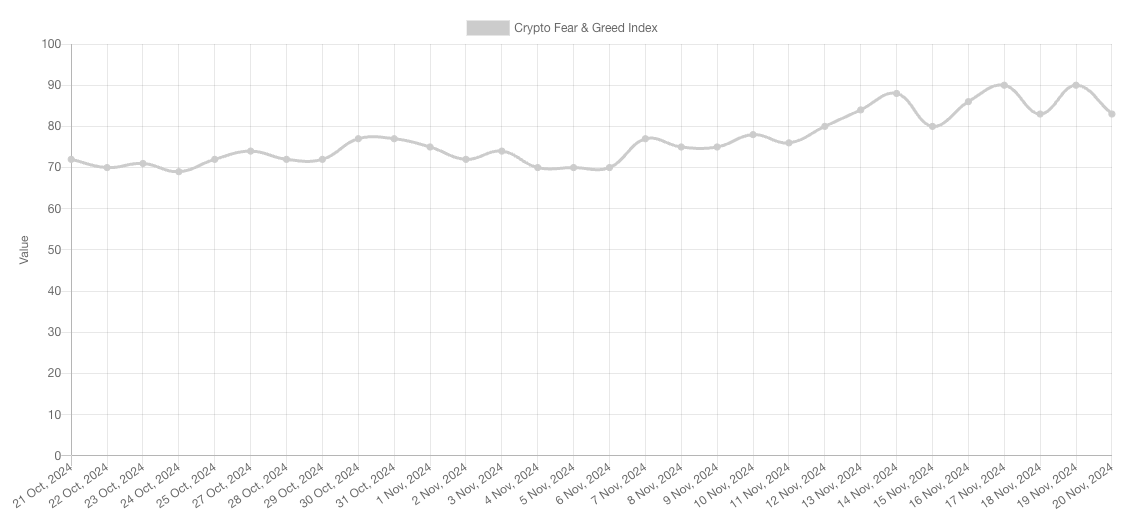

It is known that a value of over 80 on a scale of 100 points can signal a local price high. Since November 12, the index has been consistently above 80, and on November 17 and 19, it reached a record high of 90, the highest level since February 2021.

Photo: CryptoQuant

Experts pointed to the Coin Days Destroyed indicator, which tracks the sale of coins that have been inactive for a long time.

Thus, a value of more than 15−20 million may indicate a short-term decline. Currently, the indicator shows 15.1 million, which is approaching the risk zone.

Photo: CryptoQuant

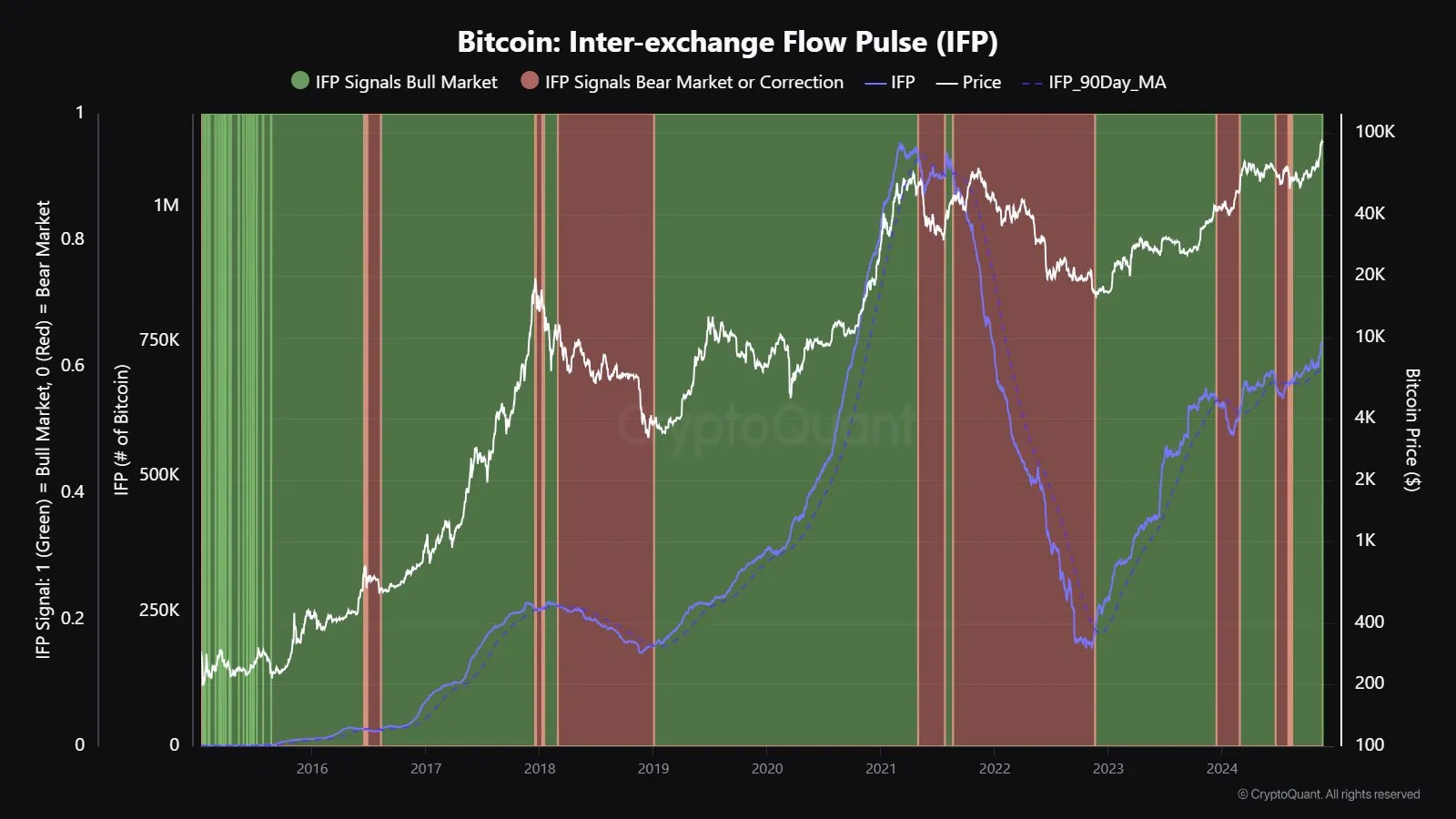

Currently, the IFP flow is 730,000, which indicates an increase in activity. In previous bullish trends, the value reached 1 million.

Photo: CryptoQuant