Subscribe to our Telegram channel

MicroStrategy could have made a much higher profit if it had bought ETNs instead of VTS

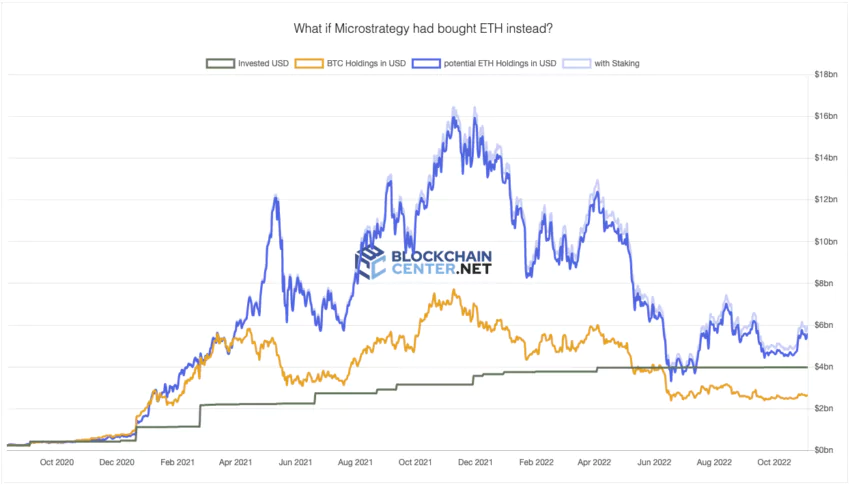

Blockchain Center has created a website to compare the cryptocurrency investments of the largest bitcoin owner MicroStrategy. Analysts used information about the company’s BTC holdings and superimposed on them a forecast of what would happen if Ethereum were to replace the flagship cryptocurrency.

MicroStrategy currently owns 130,000 BTC. The company started investing in digital gold in August 2020. Currently, the company’s total capital in bitcoin is over $ 2.63 billion at the current exchange rate. In addition, the company lost $ 1.34 billion through its own investments. According to the Blockchain Center, if MicroStrategy had bought Ethereum instead of BTC, it would have brought in $ 1.47 billion more profit than bitcoin.

Someone made a website to track what MSTR would have made if they longed ETH instead of BTC and it turns out they would be up $ 1.47 billion instead of down -$ 1.35 billion lmaooo pic.twitter.com/CKOqLLPKog

— Eric Wall X? (@ercwl) November 4, 2022

If MicroStrategy were to buy ETH at the same time as BTC, it would have 3.54 million ETH. At the current exchange rate, that’s $ 5.45 billion — roughly twice the value of the company’s assets in BTC. The Blockchain Center emphasizes that this does not include profits from staking. Taking into account ETH rates, MicroStrategy would have earned an additional 239,690 ETH, worth about $ 370 million.

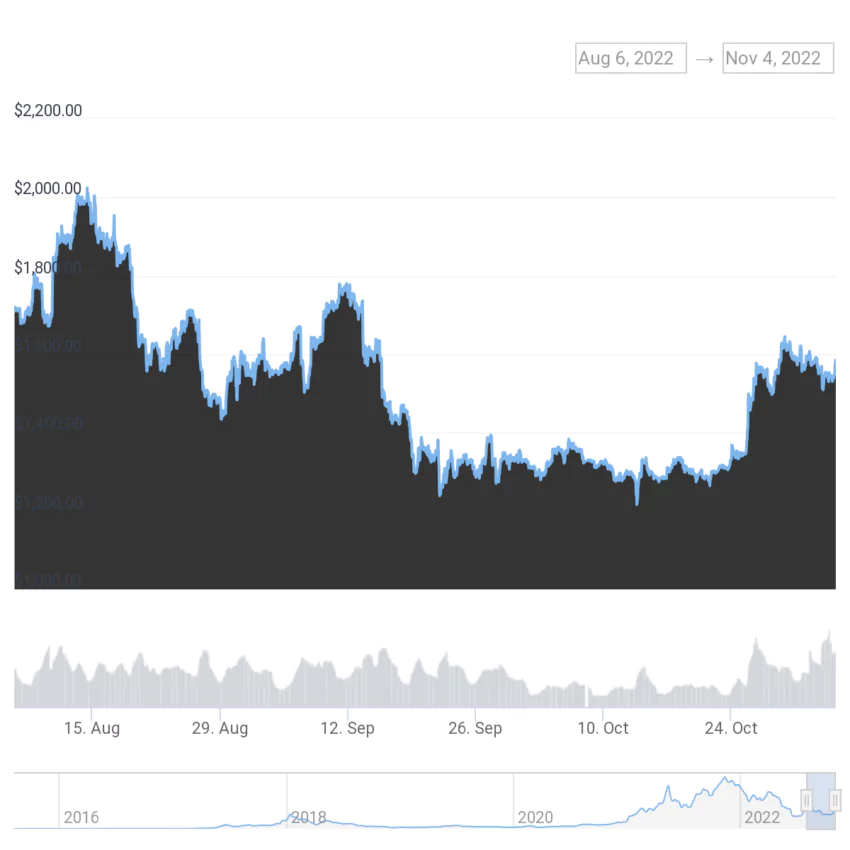

Ethereum’s performance is indeed continuing to strengthen. Experts identify three main reasons why the main altcoin has been outperforming the flagship cryptocurrency over the past month: there is no pressure from miners, the market is deflationary, and the transition to the Ethereum PoS has reduced Ethereum 's energy consumption by 99.9%. This makes the asset much more attractive to financial companies that are conscious of the environmental, social, and governance issues associated with cryptocurrencies. According to CoinGecko, ETH has grown by 20.6% over the past two weeks. For comparison, bitcoin reached only 6.8% over the same 14 days.

At the time of writing, Ethereum is trading at $ 1,581, up 1.83% over the previous day. The market capitalization of the main altcoin is $ 190.6 billion, and traders made daily deals worth $ 865.2 million.

It is worth reminding that in the third quarter of 2022, MicroStrategy’s bitcoin reserves showed a loss of $ 727,000. The total cryptocurrency losses of the tech giant amounted to $ 93.9 million, which is 39.5% less than in the third quarter of 2021. In the second quarter of 2022, MicroStrategy lost $ 918 million on bitcoin depreciation.