Subscribe to our Telegram channel

Bitcoin sales by miners set a five-year record

The bear market has been going on for a year now, but large miners have only just started selling their coins en masse. Rising global electricity prices and a drop in the price of bitcoin (BTC) have made cryptocurrency mining unprofitable. Retail miners, who were severely affected by the costs, disconnected their equipment from the network a few months ago. But the current decline in the BTC exchange rate has led even large mining pools to sell more coins to support their business.

There are two main reasons why miners sell their mined coins. The first is profit-taking when the BTC price reaches new highs. In this case, an increase in sales by miners signals a serious revaluation of the cryptocurrency market and usually occurs at the end of a long-term upward cycle.

The second reason for sales may be the extremely low price of BTC, which makes maintaining the business unprofitable. In this case, miners sell more than usual to cover current expenses and stay afloat in a bleeding market.

This is exactly what we are seeing now. on November 9, BTC fell to a low of $ 15,588. This led to the fact that even the largest bitcoin miners, who have relatively cheap energy and the best equipment, found themselves at a loss.

Today, miners are experiencing the highest pressure in almost 5 years (blue chart). The last time such high levels of the index were seen was at the peak of the bull market in 2017 and at the end of the bear market in 2018.

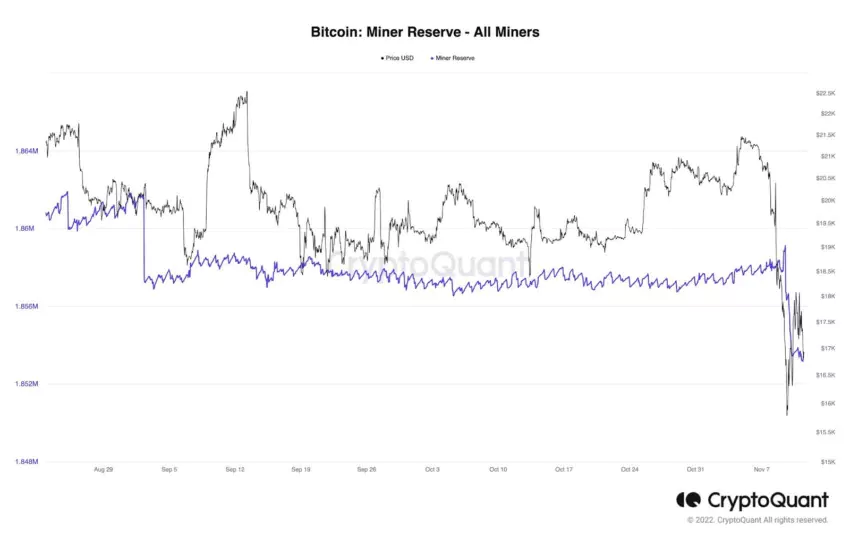

In recent days, we have seen a sharp decline in the reserves of bitcoin miners. Thus, the drop in the BTC price as a result of FUD (Fear, Uncertainty, Doubt) associated with the FTX bankruptcy was mainly caused by their capitulation.

This is confirmed by the graph of the inflow of funds to the exchange, which come from known BTC mining pools. The high values of the last few days correlate with a drop in the price of bitcoin.

But there is good news. Despite the difficulties of miners, the network’s hashrate remains at a record high. This means that the largest mining pools can still keep their equipment in working order.

According to The Wall Street Journal, large mining companies have started selling cryptocurrency mining rigs, hoping to cover losses due to the fall in the value of digital assets on the market.