Subscribe to our Telegram channel

Artificial intelligence does not believe in the growth of Ethereum cryptocurrency

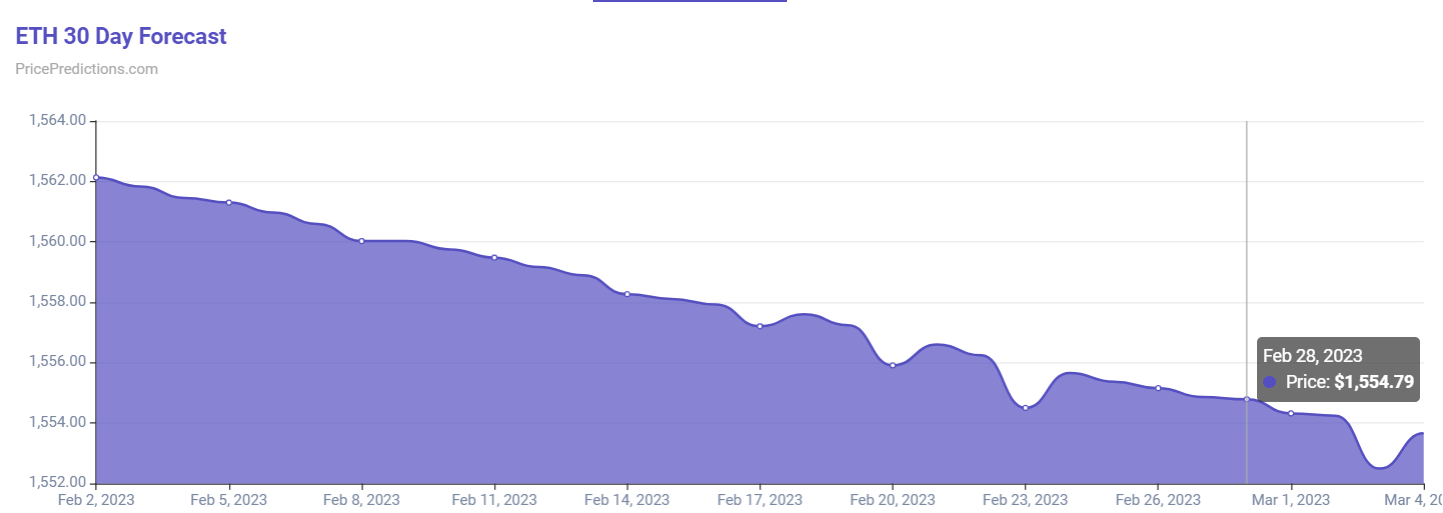

A machine learning algorithm has predicted the value of the Ethereum cryptocurrency as of February 28, 2023. According to PricePredictions, by the end of this month, ETH will be trading at $ 1555, which means a drop of several percent compared to the price at the time of publication ETH $1,963.73 Bridged Ether (StarkGate) -2.10% Market capitalization $44.98 million VOL. 24 hours $0.71 billion .

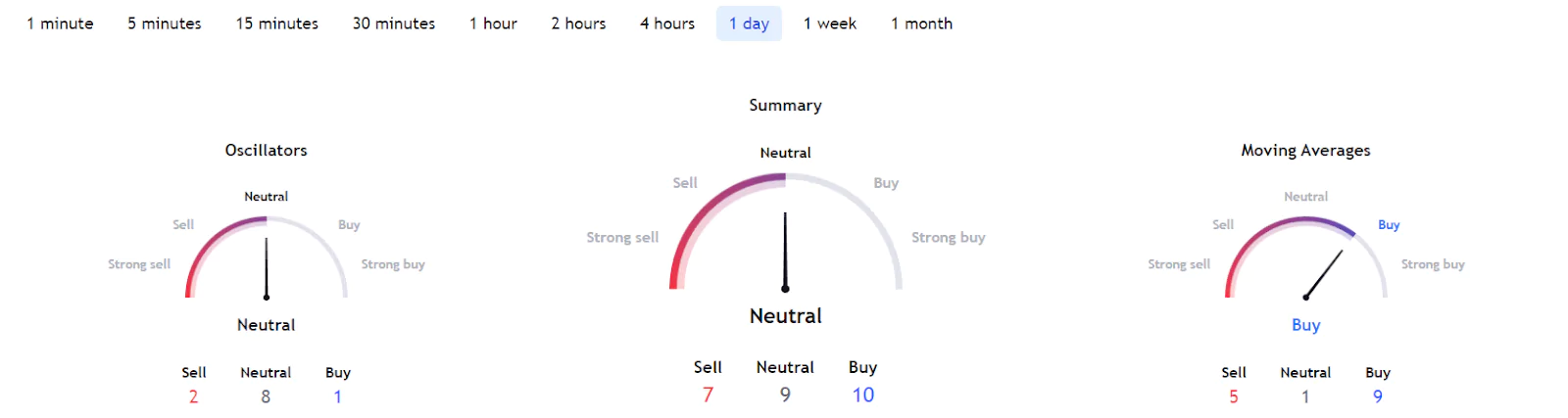

To predict the value of cryptocurrencies, the PricePredictions machine learning algorithm uses a variety of random process analysis tools, including: moving average (MA), relative strength index (RSI), moving average convergence divergence (MACD), and Bollinger Band (BB) indicator. As for the TradingViews technical analysis indicators for sentiment on 1-day oscillators, they are still largely undecided, with the summary in the «neutral» zone.

As for cryptocurrency analysts' predictions, they expect Ethereum to rise ahead of the launch of the Shanghai testnet, the next major network upgrade after the PoS switch. According to the ETH developers, the innovation will change the EVM format, add the ability to withdraw funds from the Beacon Chain, and reduce the commission to only 2. The Shanghai mainnet is scheduled to launch in March this year.

It is worth noting that despite the fall of cryptocurrencies after the collapse of the FTX exchange, the value of ethereum has been much more stable compared to other digital assets and has grown significantly since the beginning of 2023. Over the past 30 days, ETH has managed to rise by 32.3%, while BTC has increased by 39.3%.