Subscribe to our Telegram channel

Cryptocurrency payments may exceed the use of payment cards in the new year

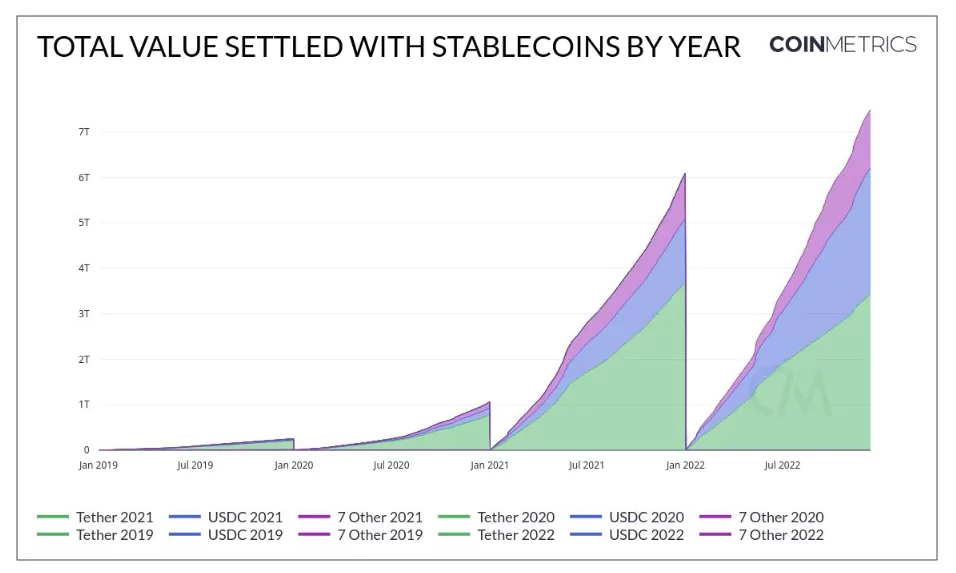

According to Coin Metrics, in 2022, payments in stablecoins reached more than $ 7 trillion. It is expected to reach about $ 8 trillion by the end of the year. At the same time, the largest card payment network Visa processes approximately $ 12 trillion per year.

Peter Johnson, co-founder of the hedge fund management company Brevan Howard Digital, said that payments with stablecoins have already surpassed Mastercard and American Express. In addition, he predicted that in 2023, the volume of payments with stablecoins in the market will exceed the number of financial transactions from Visa.

The expert also noted that next year, the volume of stablecoins is likely to exceed the total volume of all four major card networks — Visa, Mastercard, AmEx, and Discover. Johnson emphasized that when assessing the situation, he did not take into account the volume of trading on centralized exchanges.

2/ Expect that 2023 on-chain stablecoin volumes will not only surpass Visa volumes, but will also likely surpass the aggregate volume of all four major card networks (Visa, Mastercard, AmEx, and Discover).

— Peter Johnson (@TheChicagoVC) December 21, 2022

In response to the Brevan Howard Digital analyst’s forecast, many Twitter users noted that the comparison between cryptocurrencies and the classic payment system is not entirely correct, as it is worth distinguishing between credit card limits and payments with stablecoins. Credit card transactions are usually related to consumer spending, while crypto assets pegged to fiat currency are mainly associated with virtual coin trading and decentralized finance.

According to CoinGecko, stablecoins currently account for about 16.5% of the total cryptocurrency market capitalization, or about $ 140 billion. Tether remains the dominant asset with a total supply of $ 66.3 billion in coins. However, cryptocurrency experts believe that the market capitalization of the USDT token is unreasonably high. Thus, Mad Money show host Jim Cramer recently criticized Tether (USDT) because of the «inflated» market capitalization of the virtual coin: «There's an entire industry of cryptocurrency hype men who are desperate to keep them alive.» The financial media outlet advised cryptocurrency holders to get rid of their assets due to the collapse that is looming in the industry in 2023.